Dr.S.L.N.T.Srinivas

Dr.S.L.N.T.Srinivas

Expert in Cooperative Governance & Management

Member, All India Authors Group

NCCT: Ministry of Cooperation, Govt. of India

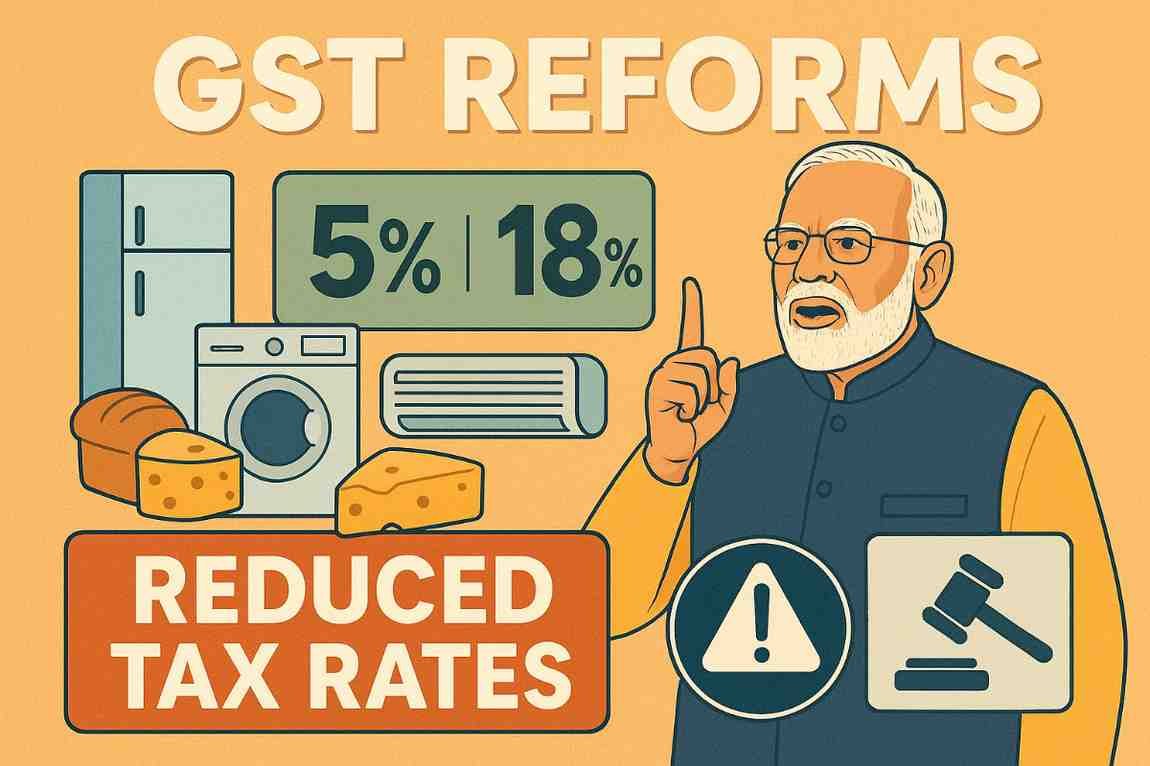

The year 2025 marks a new phase in India’s economic and tax reforms, with the Government introducing significant changes to the Goods and Services Tax (GST) framework. While the reforms are expected to streamline compliance, boost transparency, and expand the tax base, their implications for the cooperative sector remain a subject of deep discussion. Cooperatives, being unique member-driven institutions that straddle both social and business objectives, are positioned at a critical juncture. The question that arises is—to what extent will the new GST reforms impact cooperatives?

1. Rationalisation of GST Rates

The 2025 reforms focus on rationalising the GST rate structure by reducing the multiplicity of slabs. For cooperatives engaged in agriculture, dairy, fisheries, and handicrafts, this could translate into simplified compliance and reduced classification disputes. Lower or uniform tax rates on essential cooperative activities—such as fertilizers, milk products, or primary agricultural produce—could provide relief to members. However, if certain inputs continue to be taxed at higher rates without corresponding input tax credit benefits, cooperatives may still bear hidden costs.

2. Threshold Exemptions and Small Cooperatives

One of the highlights of the reforms is the enhancement of the GST exemption threshold for small entities. Many Primary Agricultural Credit Societies (PACS), housing cooperatives, and small dairy units may fall outside the GST ambit, reducing their compliance burden. This reform is particularly relevant for rural cooperatives, which often lack the digital infrastructure or skilled manpower to handle complex GST filings. At the same time, cooperatives operating at scale may face higher expectations for accurate reporting and transparency.

3. Digital Compliance and E-Invoicing

The 2025 reforms accelerate the push toward digitisation with universal e-invoicing, real-time reporting, and stricter matching of input and output credits. For well-managed and professional cooperatives, this presents an opportunity to strengthen governance and build credibility with

_________________________

* Expert in Cooperative Governance , Member, All India Authors Group, NCCT: Ministry of Cooperation, Govt. of India

members and markets. However, smaller cooperatives in rural areas may struggle to adapt due to low digital literacy and inadequate internet penetration. Bridging this digital divide will be crucial if cooperatives are to benefit rather than suffer from the reforms.

4. Input Tax Credit (ITC) Reforms

One of the most debated aspects of GST reforms is the seamless flow of Input Tax Credit. By tightening rules on ITC claims and linking them directly with suppliers’ compliance, cooperatives will need to ensure that their supply chain partners are fully compliant. This increases operational discipline but also adds a layer of risk—especially for agricultural marketing cooperatives sourcing from small farmers who are outside the GST net. Unless special carve-outs are designed, cooperatives may face cash-flow pressures.

5. Impact on Cooperative Services

The reforms extend GST coverage to newer categories of services, including some areas of financial and consultancy services provided by cooperatives. For credit societies, urban banks, and cooperative housing societies, this could mean additional tax liabilities. At the same time, the government has indicated its intent to exempt certain social-welfare-driven services provided by cooperatives, ensuring that their developmental mandate is not diluted.

6. Transparency, Governance, and Member Trust

A positive spillover of GST reforms is the boost to transparency and record-keeping. With e-invoicing and digital trails, instances of misappropriation or fund diversion within cooperatives can be significantly curtailed. This aligns with the government’s larger vision of professionalising cooperatives and enhancing member participation through trust and accountability.

7. Challenges Ahead

Despite the positives, challenges remain. Compliance costs, the need for constant digital updates, and dependence on professional expertise may strain cooperatives with limited resources. There is also the risk that the uniform application of GST norms does not fully recognise the social and developmental nature of cooperatives vis-à-vis private businesses.

Conclusion

The GST Reforms 2025 are a double-edged sword for cooperatives. On one hand, they promise simplification, transparency, and credibility; on the other, they pose compliance and operational challenges, particularly for rural and small cooperatives. The extent of impact will largely depend on how sensitively the reforms are implemented and whether cooperative-specific exemptions or facilitation measures are built into the framework.

Ultimately, cooperatives must view these reforms not as an obstacle but as an opportunity—an opportunity to professionalise operations, adopt digital tools, and reinforce their dual role as both economic enterprises and social institutions.